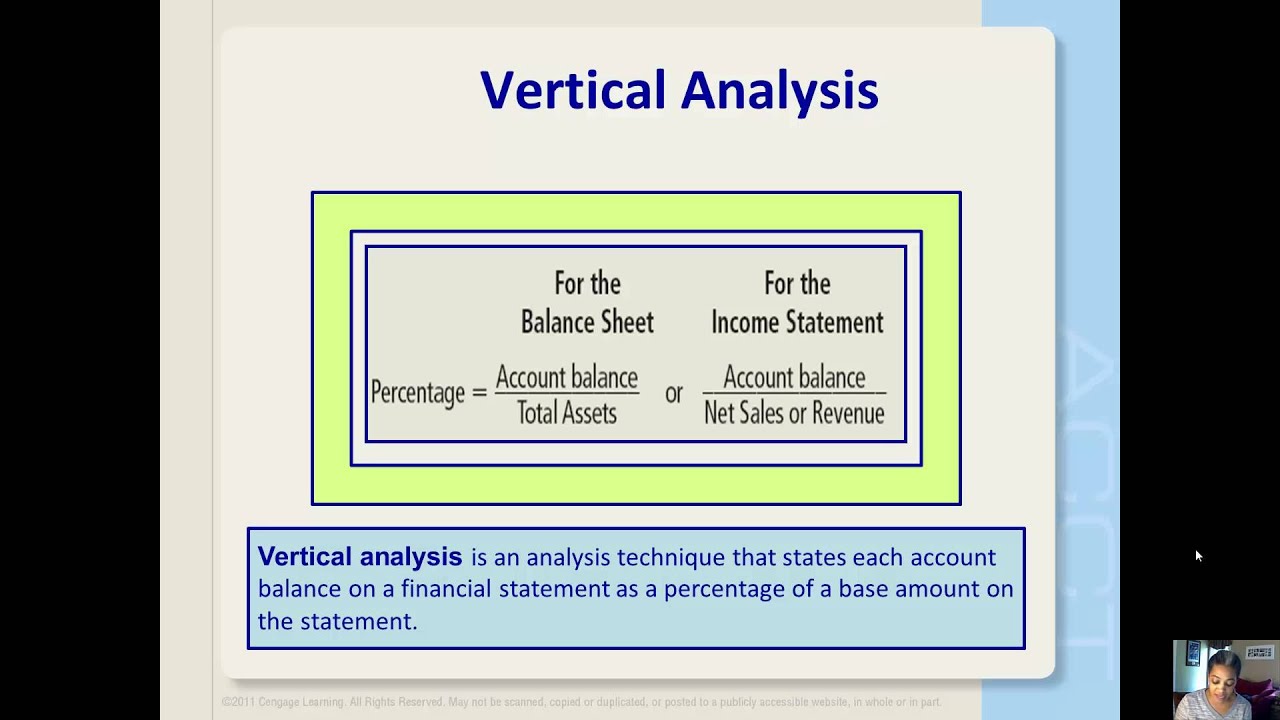

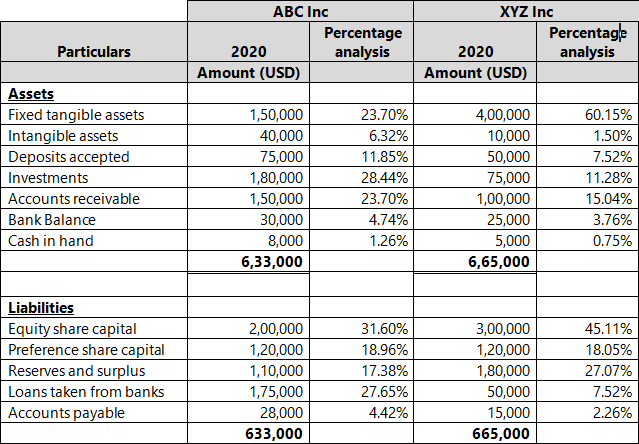

Horizontal analysis allows investors and analysts to see what has been driving a company's financial performance over several years and to spot trends and growth patterns. This type of analysis enables analysts to assess relative changes in different line items over time and project them into the future. In this form of financial statement analysis, financial data of a single accounting period is compared with other financial data of the same entity of the same accounting period. For vertical analysis, a base line item in the financial statements is chosen and all other line items are expressed in percentage terms relative to the selected base item. In summary, horizontal and vertical analysis offer complementary perspectives for analyzing financial statements.

Private Equity: Financing, Investing, and Value Creation

This percentage method is most useful when identifying changes over a longer period of time where there may be significant deviations from the base period to the current period. Both horizontal and vertical analysis hold their own place in financial statements analysis. While each has its distinct advantages and disadvantages, they are often used together to give a more comprehensive comparative picture to stakeholders. They, together, are key to understanding the financial position of a business entity.

Horizontal analysis:

Since applications with low, real-time latency and high-speed performance are demanded, vertical scaling is generally used since there is no network delay between servers. Although horizontal scaling improves resilience, data needs to move between nodes, which might, to some extent, introduce a delay that may affect latency-sensitive applications. Applications designed difference between horizontal and vertical analysis for a distributed environment benefit more from horizontal scaling, allowing their loads to distribute across several nodes. On the other hand, applications operating on a single server and with low traffic would benefit more from vertical scaling. This is because periodic hardware upgrades would result in adequate performance without a complex server network.

Horizontal vs Vertical Financial Analysis

Understanding these core statements, how they interrelate, and the accounts that compose them is essential for accurate and effective financial analysis. A horizontal balance sheet shows assets on the right-hand side, while a vertical balance sheet shows assets below liabilities. Analyzing financial statements is critical, yet most find it challenging to interpret the data.

Profitability Ratios

By examining the percentage change or difference between two or more periods, businesses can assess their growth or decline in key areas. When it comes to analyzing financial statements, businesses have various tools at their disposal. These techniques help organizations gain insights into their financial performance, identify trends, and make informed decisions. While both horizontal and vertical analysis serve similar purposes, they differ in their approach and the information they provide. In this article, we will explore the attributes of horizontal analysis and vertical analysis, highlighting their key differences and benefits. Although both horizontal and vertical analysis is used in the analysis of financial statements, they have several differences.

- It is most valuable to do horizontal analysis for information over multiple periods to see how change is occurring for each line item.

- Overall, horizontal analysis delivers insights into the company's historical performance.

- Businesses can achieve this by adding server instances only when demand goes up, making it cost-effective and scalable.

- Vertical and horizontal analysis are considered two distinct methods of financial analysis that serve different purposes.

For example, if salaries expense as a percentage of total expenses increases over several years, it indicates that salaries are making up a greater portion of total costs. In summary, the horizontal format emphasizes the accounting equation, while the vertical format allows easier analysis of sub-accounts over time. First, a direction comparison simply looks at the results from one period and comparing it to another. For example, the total company-wide revenue last quarter might have been $75 million, while the total company-wide revenue this quarter might be $85 million. This type of comparison is most often used to spot high-level, easily identifiable differences. Both horizontal and vertical scaling have distinct use cases, depending on the application’s requirements.

Both methods provide valuable insights into a company's financial operations and are useful for assessing historical performance, forecasting future performance, and comparing companies within an industry. This allows you to see how each account on the balance sheet and income statement has increased or decreased in dollar terms over the periods analyzed. For example, if a company's current year (2022) revenue is $50 million in 2022 and its revenue in the base period, 2021, was $40 million, the net difference between the two periods is $10 million. By dividing the net difference by the base figure, the percentage change comes out to 25%. All of the amounts on the balance sheets and the income statements for analysis will be expressed as a percentage of the base year amounts. The performance and network latency requirements are important in selecting the scaling approach.

There is a baseline period and numbers from succeeding periods are calculated as a percentage of the base period. Vertical analysis looks at numbers in financial statements in the same period and calculates each line item as a percentage of the base figure in that section. Financial statements that include vertical analysis clearly show line item percentages in a separate column. These types of financial statements, including detailed vertical analysis, are also known as common-size financial statements and are used by many companies to provide greater detail on a company’s financial position.

Finance professionals use it with other financial analysis methods to comprehensively understand a company’s financial position. Horizontal analysis is a method of evaluating a company's financial statements over time to detect trends and identify variances in performance. By comparing numbers across consecutive accounting periods, horizontal analysis quantifies increases or decreases as a percentage. Horizontal analysis allows financial statement users to see trends over time and evaluate the performance growth rates of line items like revenue, expenses, assets, and liabilities. Analysts and investors apply it to assess management effectiveness and operating efficiency.

By doing the same analysis for each item on the balance sheet and income statement, one can see how each item has changed in relationship to the other items. Vertical analysis makes it much easier to compare the financial statements of one company with another and across industries. There’s a wealth of data lurking inside your company’s financial statements—and if you know how to analyze it effectively, you can transform financial information into actionable insights. Common size financial statements reveal how cost and profitability structures align with competitors.