In applications that demand high availability and resiliency, this strategy avoids single points of failure. In an absolute analysis, financial data in the form of absolute values are compared year on year. We’ll start by inputting our historical income statement and balance sheet into an Excel spreadsheet. For example, the amount of cash reported on the balance sheet on Dec. 31 of 2024, 2023, 2022, 2021, and 2020 will be expressed as a percentage of the Dec. 31, 2020, amount. Another similarity to horizontal analysis is vertical analysis’ utility during external as well as internal analysis.

Main Differences Between Horizontal and Vertical Analysis

After squaring the differences and adding them up, then dividing by the total number of items, we find that the variance is $5,633,400. You can examine the data from horizontal analysis in a number of ways, depending on your goals. This analysis might lead the e-commerce company to investigate ways to increase margins through pricing optimization or cost reductions in order to reach industry benchmarks. Applying this for every line item quantifies performance increases or decreases over time as a percentage. No, the best method depends on business needs, workload patterns, budget, and infrastructure; often, a mix of both scaling types offers the most flexibility and efficiency. Scaling up or out infrastructure lets organizations innovate, not being held by the bonds of capacity or performance.

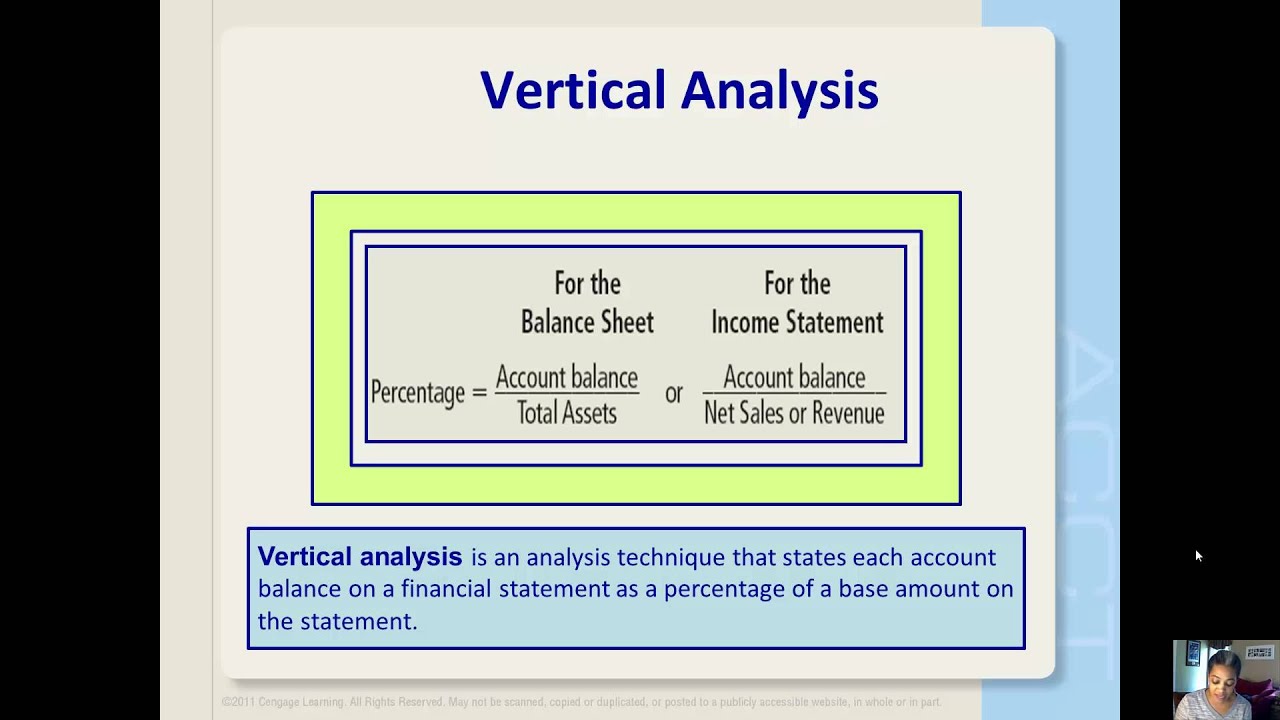

Calculating Ratios: Vertical Analysis Formulas

For example, if a corporation’s net income declines over time, it may suggest that the company is suffering decreased demand or rising competition. Additionally, individuals can make more informed investment decisions by analyzing the percentage change in each line item over time. This means Mistborn Trading saw an increase of $20,000 in revenue in the current year as compared to the prior year, which was a 20% increase. The same dollar change and percentage change calculations would be used for the income statement line items as well as the balance sheet line items. The figure below shows the complete horizontal analysis of the income statement and balance sheet for Mistborn Trading. Vertical analysis converts all amounts on a financial statement to a percentage of a chosen benchmark figure, often total assets or total revenues.

Definition of Horizontal Analysis

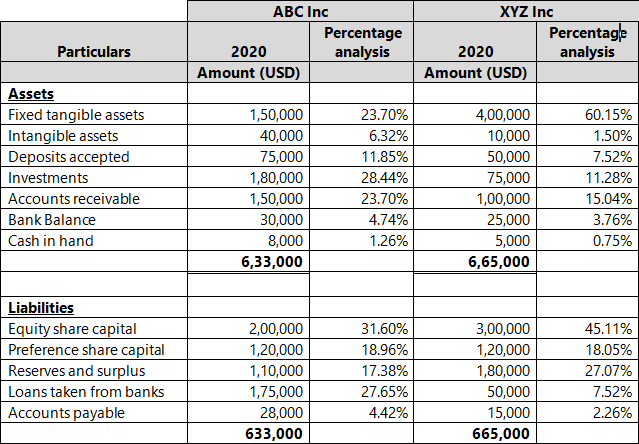

While horizontal analysis is useful in income statements, balance sheets, and retained earnings statements, vertical analysis is useful in the analysis of income tax, sales figures and operating costs. Horizontal analysis refers to the comparison of financial information such as net income or cost of goods sold between two financial quarters including quarters, months or years. One of the key benefits of vertical analysis is its ability to highlight the relative importance of different line items within difference between horizontal and vertical analysis a financial statement. By expressing each item as a percentage, businesses can easily compare and evaluate the significance of various components. For example, a company may find that its cost of goods sold represents a higher percentage of net sales compared to industry averages, indicating potential inefficiencies in the production process. Vertical analysis is the proportional analysis of a financial statement, where each line item on the statement is listed as a percentage of another item.

The difference between vertical analysis and horizontal analysis

On the other hand, in vertical financial analysis, an item of the financial statement is compared with the common item of the same accounting period. So in summary, horizontal analysis looks at year-over-year trends by comparing figures from the current period to a base period. This allows financial statement users to see relative changes over time and spot trends.

Key Differences Between the Applications of Vertical and Horizontal Analysis

- It allows you to see changes in an account from one accounting period to another, expressed as a percentage.

- In this regard, horizontal and vertical scaling allow companies flexibility in adjusting to demand fluctuation.

- The priority here should be to identify the company’s areas of strengths and weaknesses to create an actionable plan to drive value creation and implement operating improvements.

- All of the amounts on the balance sheets and the income statements will be expressed as a percentage of the base year amounts.

Scaling a server infrastructure becomes indispensable because a well-scaled server infrastructure maintains smooth performance, particularly during periods of heavy workload. This minimizes the possibility of downtimes and lags, thereby protecting user experience and productivity and facilitating business growth. Scaling a server infrastructure optimizes resource usage and increases cost-effectiveness due to reduced or eliminated expenses used in upgrading outdated systems. The following blog discusses further vertical and horizontal analysis, key differences, and other relevant aspects in detail.

Cash in the current year is $110,000 and total assets equal $250,000, giving a common-size percentage of 44%. If the company had an expected cash balance of 40% of total assets, they would be exceeding expectations. This may not be enough of a difference to make a change, but if they notice this deviates from industry standards, they may need to make adjustments, such as reducing the amount of cash on hand to reinvest in the business.

By calculating the difference and converting to percentages, we can quickly create a thumbnail snapshot of revenue growth or contraction. Vertical analysis expresses each amount on a financial statement as a percentage of another amount. For example, an airline with an operating margin of 25% significantly outperforms the industry average of 8%. Benchmarking these ratios facilitates performance comparisons and analysis of trends. This shows that for every $1 of revenue, ACME spends $0.60 on costs of goods sold, $0.40 on gross profit, $0.20 on operating expenses, and ultimately has $0.20 left as net income.

This section will provide numerical examples demonstrating horizontal and vertical analyses using both income statements and balance sheets. Horizontal analysis is more applicable for studying a company's growth trajectory over multiple periods. Vertical analysis is more useful for benchmarking against industry averages and identifying outliers in period-specific financial data. Choosing appropriate base amounts and comparing vertical analysis percentages over time lets you analyze changes in the financial structure and performance of a company. This is a simple example of performing a horizontal analysis on the income statement to analyze the trend in revenue over time. Vertical analysis gives visibility into the composition and relative weightings across your financial levers.